Are You Overlooking the Power of Interest Rate Investment Strategies?

Interest rates might sound dull, but here’s the twist: they are the unsung hero of your financial story. Yes, interest rate investment strategies are a game-changer, no matter where you are on your investing journey.

Everything from stocks and bonds to real estate is impacted by interest rates. Whether rates rise, fall, or fluctuate unpredictably, having a smart interest rate investment strategy ultimately gives you an edge. For instance, understanding how interest rate investment strategies affect your investments can help you make more informed decisions. As a result, interest rate investment strategies can become your secret weapon for navigating any economic environment.

Interest Rates: Their Role in Interest Rate Investment Strategies

Interest rates are the pulse—the rhythm that drives financial markets. Therefore, understanding how they impact investments is crucial for success.

- Rising rates: Typically challenge sectors like real estate and high-growth stocks while benefiting defensive assets.

- Falling rates: Create opportunities for growth stocks and bonds.

By tailoring your interest rate investment strategies, you position your portfolio to adapt to these shifts, ultimately gaining a financial advantage. Additionally, strategies like financial leverage can enhance your returns by providing access to more capital, particularly in the real estate sector. Learn more about financial leverage here.. Learn more about financial leverage here.

How to Align Your Investment Strategy with Interest Rate Cycles

Interest rates are like the weather—sometimes sunny, sometimes stormy. Therefore, knowing how to “dress” your investments for the financial climate is key to staying ahead. In addition, understanding the ebb and flow of interest rates will allow you to make smarter, more strategic decisions.

But a great investment strategy isn’t just about reacting to interest rates; it’s about being prepared. First, start with a solid financial foundation: save up, track your funds, and stay flexible to seize opportunities. Additionally, want to make your money work harder? In that case, check out our guide on budgeting tips for simple ways to manage your cash. Learn more here.

Top Interest Rate Investment Strategies: Bonds, Stocks, and Real Estate

1. Bonds: Your Rate-Responsive Ally

Bonds are the bread and butter of rate-sensitive investing. When rates drop, bond prices climb—but there’s more to the story. Here’s what to do:

- Hedge risks with a mix of short-term bonds and inflation-protected securities.

- Explore high-yield corporate bonds for better returns.

Including bonds in your interest rate investment strategies offers stability and predictable returns. Moreover, bonds provide steady income, making them a reliable option for managing risk. Learn more about how bonds can enhance your portfolio in our detailed guide.

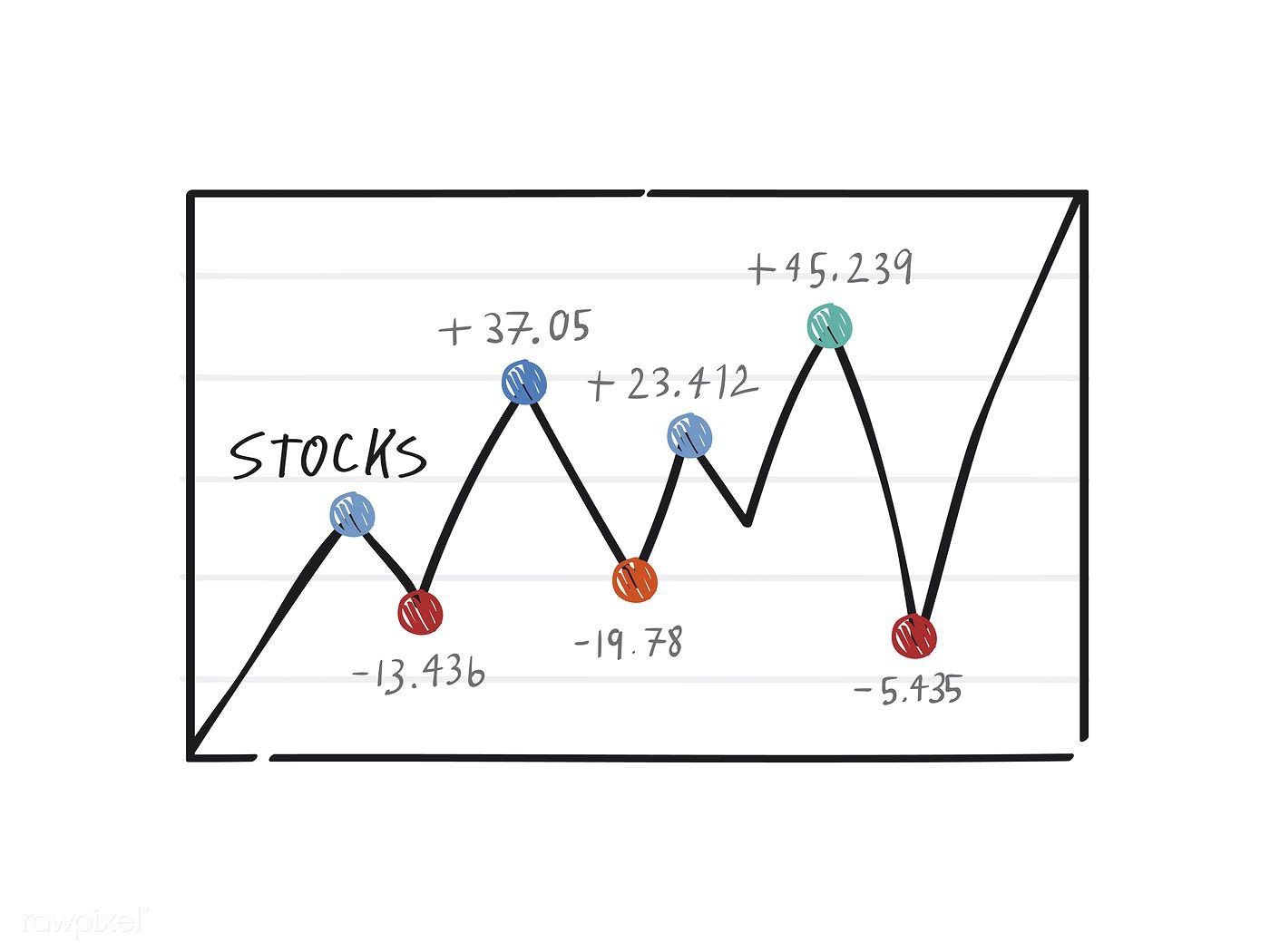

2. Sectors That Shine in the Stock Market

Not all stocks react to interest rates the same way. Therefore, focusing on rate-sensitive sectors can help you achieve better results.For instance, sectors like utilities and real estate often benefit from lower rates.

- Invest in growth stocks during low-rate periods for potential gains.

- Opt for dividend-paying stocks during rate hikes for steady income.

Additionally, focus on rate-resilient sectors like healthcare, technology, and consumer staples to stay ahead.

3. Real Estate: Beyond Conventional Investments

Real estate, particularly REITs (Real Estate Investment Trusts), adapts well to interest rate changes. Key benefits include:

- Steady dividend income.

- Lower volatility compared to stocks.

As a result, including REITs in your investment strategies for interest rates adds both stability and growth potential.

Preparing for the Next Economic Cycle with Interest Rate Investment Strategies

The financial landscape is always evolving. Therefore, staying prepared is essential. Here’s what to anticipate in the near future:

- Central bank decisions: In light of ongoing economic challenges, potential rate cuts may be implemented to stimulate growth and support recovery.

- Persistent inflation risks: As inflation continues to pose a threat, it is shaping the direction of economic policies and influencing key decisions moving forward.

- Volatility opportunities: Amid these fluctuations, adopting a flexible and diversified investment approach is crucial, as it allows you to capitalize on potential opportunities and mitigate risks.

Because these trends are unpredictable, refining your investment strategies for interest rates keeps you one step ahead.

Building Winning Investment Strategies for Interest Rates: Simple Steps to Start Now

Crafting the right investment approach doesn’t have to be intimidating. In fact, with the right strategies in place, you can confidently navigate the market and make informed decisions. Moreover, taking a step-by-step approach will help you stay on track and adjust your plan as needed. For instance, consider these steps:

- Stay informed: Keep tabs on market news and rate trends. Additionally, staying informed will help you adjust your strategies and make timely, well-informed investment decisions.

- Seek advice: A financial advisor can tailor strategies to your needs. Additionally, if you’re seeking expert insights on customizing your investment strategies, check out this in-depth article on financial advisor tips for navigating interest rate environments.

- Experiment safely: Try ETFs or low-risk options to build confidence.

In the end, successful investment strategies for interest rates rely on patience, knowledge, and adaptability. Moreover, if you’re interested in exploring investment options that work well in fluctuating interest rate conditions, here’s a great resource on investing in volatile markets that will help guide you further.

VIDEO Source: https://www.youtube.com/watch?v=Inxaa90G9DA

Unlocking the Power of Interest Rates for Your Investment Success

Are you ready to unlock the full potential of interest rates? By adopting thoughtful investment strategies for interest rates, you’ll be able to navigate any economic climate with confidence. Consequently, you can make informed decisions that boost your financial success. Therefore, now’s the time to embrace the possibilities and let your investments flourish—no matter where rates go next!

FAQs

1. What are investment strategies for interest rates?

Adjust your portfolio based on interest rate trends by focusing on bonds, stocks, and real estate. Consequently, this will ensure optimal returns and better financial outcomes.

2. Do rising interest rates mean bad news for investments?

Not necessarily. While rising rates may pressure growth stocks and bonds, they can benefit sectors like finance and dividend-paying stocks.

3. How often should I review my investment strategy?

It’s a good idea to revisit your strategy quarterly or whenever there are major economic announcements, such as central bank rate decisions.

4. Are investment strategies for interest rates suitable for beginners?

Absolutely! By taking the right approach and focusing on diversified, low-risk options, beginners can confidently navigate rate-driven markets. As a result, they can minimize risk while maximizing potential returns.