Budgeting Tips: Your Ultimate Guide to Smart Money Management

Managing your money doesn’t have to be a chore. Just a few basic budgeting tips can turn it into a powerful force for achieving just about anything. Budgeting does a lot: it reduces stress and brings confidence in oneself with finances. Whether you’re saving up for a huge dream, you want to cut unhelpful spending, or maybe you just want to stress less, you’ve come to the right place. Ok, let’s get deep into very practical, valuable budgeting tips which surely change your outlook when dealing with cash.

1-Effective Budgeting Tips for Financial Success

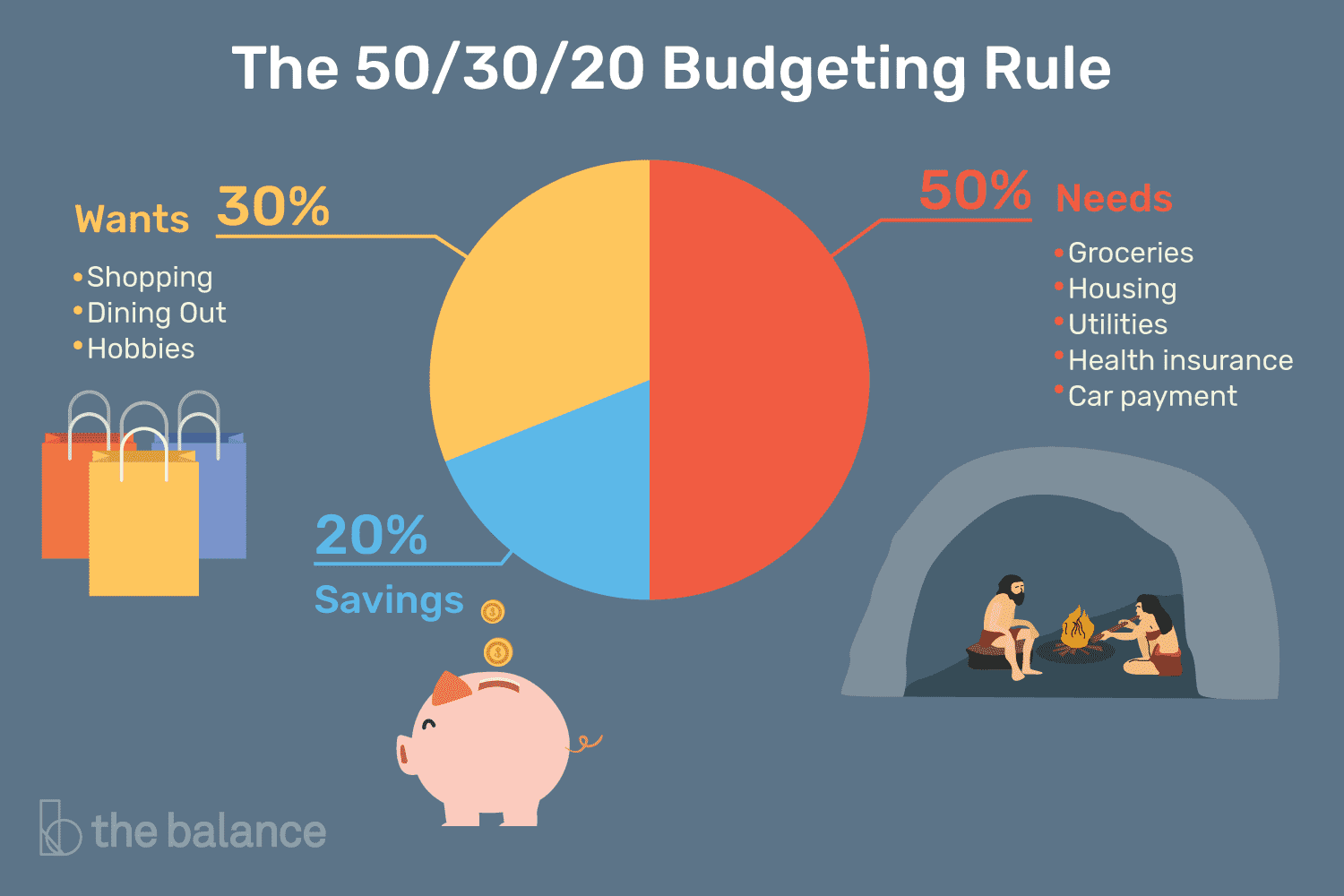

First things first, let’s keep it simple! For instance, the 50/30/20 rule is a real game-changer:

- 50% of your income goes to needs: rent, food, bills.

- 30% wants: dining out, hobbies, Netflix.

- 20%? Straight into savings or debt repayment.

This method, above all, is balanced and easy to follow; thus, once tried, budgeting tips will seem like some kind of fun strategy game!

2.Tracking Every Dollar Spent: Budgeting Tips to Effectively Monitor Your Expenses

Have you ever wondered where all my money went? Well, you are not alone! It gives you the whole picture of your spending habit: where and what you have spent your money on, be it through an app, a journal, or a spreadsheet.

You will also be opening your eyes to those sneaky areas where the little things add up, such as daily coffee runs. You might be surprised at how good it feels just to know where every penny of your money is going. Evidently, this is one of the best ways to take control over your finances through budgeting.

3. Automated Savings – A Budgeting Tip Certainly Not to Overlook

In terms of savings, automation is literally your best friend. Set up automatic transfers to your savings account every payday, even if it’s just a small amount.

Amazingly, it makes quite a difference even if you start as low as 5% of your income. Magic, but even better: financial discipline in full action! But don’t stop here-the important thing to remember is that saving doesn’t mean only to put money aside for the future, it also means to have one in case something unexpected happens. Consider building up an emergency fund as an important step in establishing a secure financial foundation.

For more on building an emergency fund, refer to our in-depth guide on Understanding Savings and Investments, where we delve deep into strategies for safeguarding your future finances. And remember, always pay yourself first!

4. Budgeting gets fun with challenges.

Who says budgeting has to be boring? Spice it up with challenges!

- The No-Spend Challenge: Select any one week of your choice every month to spend on no, or almost no, “unnecessary things.”.

- Savings Streak: Save an increasing amount every week, starting with $1, then $2, and on and on.

Not only do these challenges keep budgeting fresh and exciting, but they also show you how creative you can get with your spending habits. Looking for inspiration? More creative financial challenges are available in this guide on financial challenges to boost your savings and spending habits.

5. Utilize the tools that will make budgeting easy.

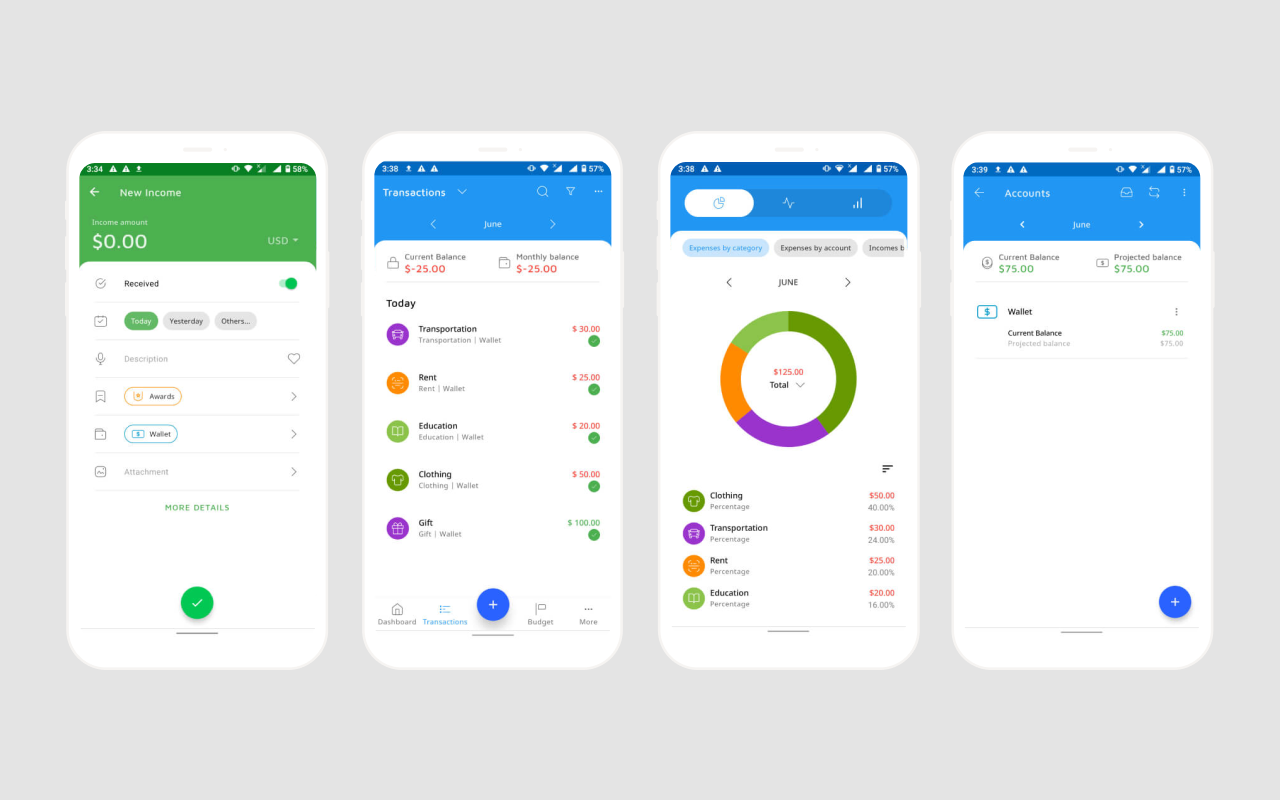

Budgeting in today’s digital age has become even easier than ever. Consider these applications:

- Mint is: Excellent for expense recordkeeping, and for doing some budget planning.

- YNAB (You Need A Budget): Best for goal-oriented savers.

- PocketGuard: Shows you how much is “safe to spend.”.

You can also try new apps in order to find the one which will fit your style. Besides, you will be surprised how easy budgeting will become once you choose the right tool. Herein, a review of top-budgeting apps, recommended by finance experts for further reading.

6. How to Celebrate Wins with Simple Budgeting Tips

Last but not least, celebrate with every milestone! Budgeting isn’t all about those restrictions; actually, it gives you freedom from some of the common monetary burdens there are. At the end, did you stick strictly to your budget this month, pay off the debt, or, say, develop an emergency fund?

Then, it is okay to reward yourself-conscientiously, of course. Small rewards make for an excellent way of keeping yourself at the task and also remind you how fabulous you are for doing this excellent job. After all, due to these tips to budget, progress might feel amazing.

Closing Thoughts

Mastering one’s finances does not come about overnight. However, with due consistency and these budgeting tips, you are sure to be well on your way to a brighter, stress-free future. After all, budgeting is not about deprivation; it is about empowerment. So take the leap-you’ve got this!

Frequently Asked Questions:

1-What’s the easiest budgeting tip for beginners?

The 50/30/20 rule is a simple starting point since it’s basic and flexible. You split your income into needs, wants, and savings.

2-How can I follow a budget without feeling constricted?

Turn budgeting into a challenge or game, like a no-spend week. This keeps it fun and encourages creativity in managing your money.

3-Are budgeting apps secure?

Yes, most of the reputable applications, such as Mint and YNAB, use encryption to keep your data secure. Always research the privacy features of an application before using it.

4-How often should I update my budget?

Review it monthly to track the progress and adjust for changes either in income or expenses. Regular updates keep your budgeting relevant and effective