ETFs Are Not a Scam: Here’s How They Can Make You Rich!

Many people have concerns regarding ETFs, whether an ETF is a safe investment opportunity or a financial fad. In fact, ETFs are not a fraud but one of the most reliable wealth builders in the long-term. With ease of access, diversity, and low cost, ETFs have become an ideal investment for new and seasoned investors alike.

What You Will Learn

- What ETFs stand for and how they function

- Why ETFs are a smart investment for beginners and experienced investors

- How to shatter misconceptions surrounding ETFs

- Actionable tips for starting your ETF investing journey.

What Are ETFs and How Can They Help You Build Wealth?

The Basis of Wealth

ETFs (exchange-traded funds) are portfolios of stocks, bonds, or commodities that trade on an exchange just like individual stocks. In addition, they offer diversification, liquidity, and low costs. As a result, these factors make ETFs essential for building a strong and balanced portfolio.

How ETFs work to make one wealthy

Purchasing an ETF means investing in a basket of assets in a fund. For example, an ETF that contains Apple, Microsoft, and Tesla stocks provides exposure to multiple companies without buying single stocks. Diversification minimizes risk but also maximizes growth. Besides, ETFs are transparent, and investors can track holdings at any moment.

Why Investing Isn’t a Scam: Key Benefits for Investors

Diversification Without Complexity

A major advantage of ETFs is diversification at a single go. Instead of investing in a single stock or a single bond, you spread your investments over a range of assets. That way, even when a single company fails, it won’t hurt your portfolio much. For instance, a technology ETF carries stocks in a range of technology companies, and a single loss won’t destroy your gain.

Unrivalled Cost Effectiveness

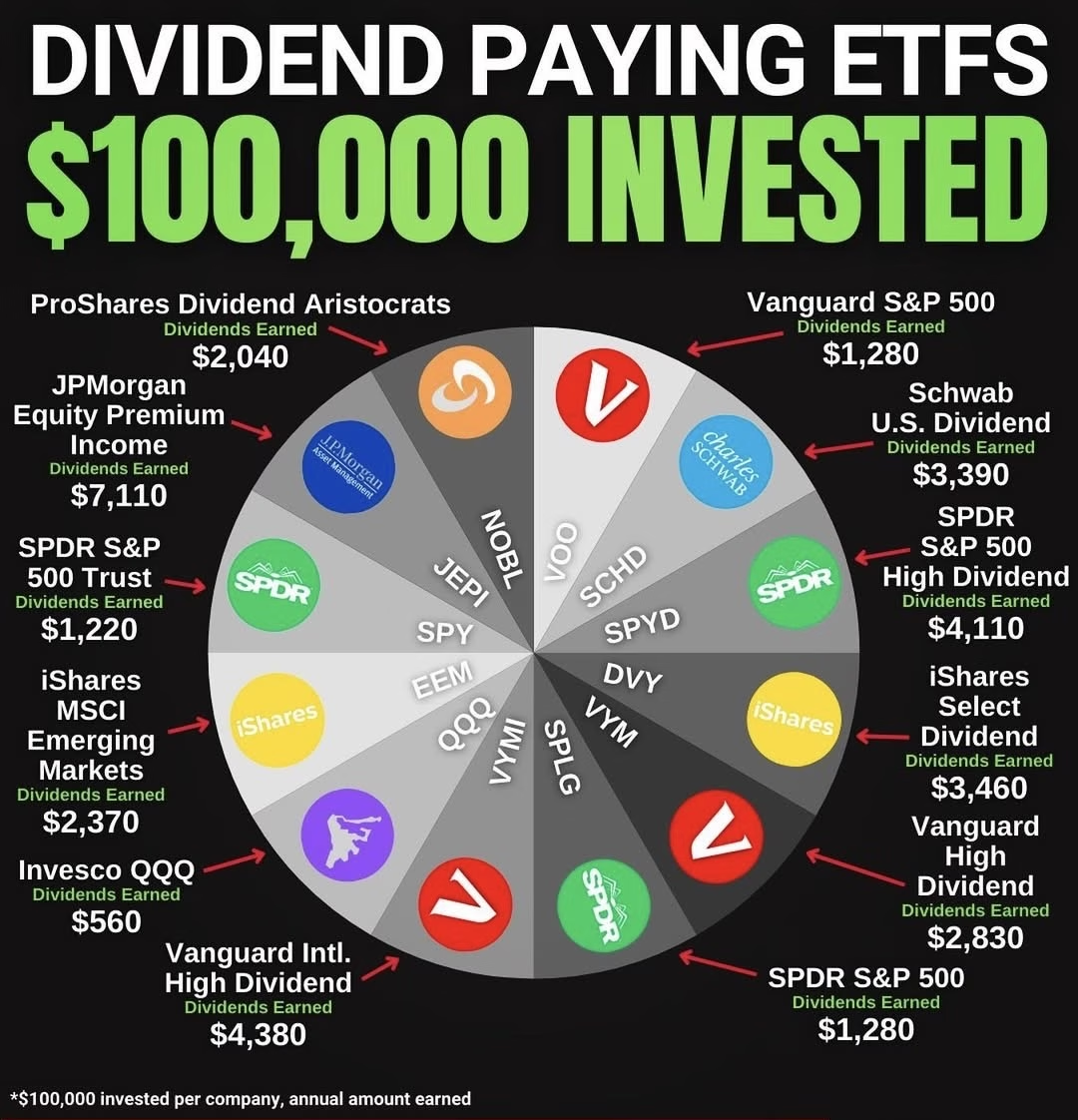

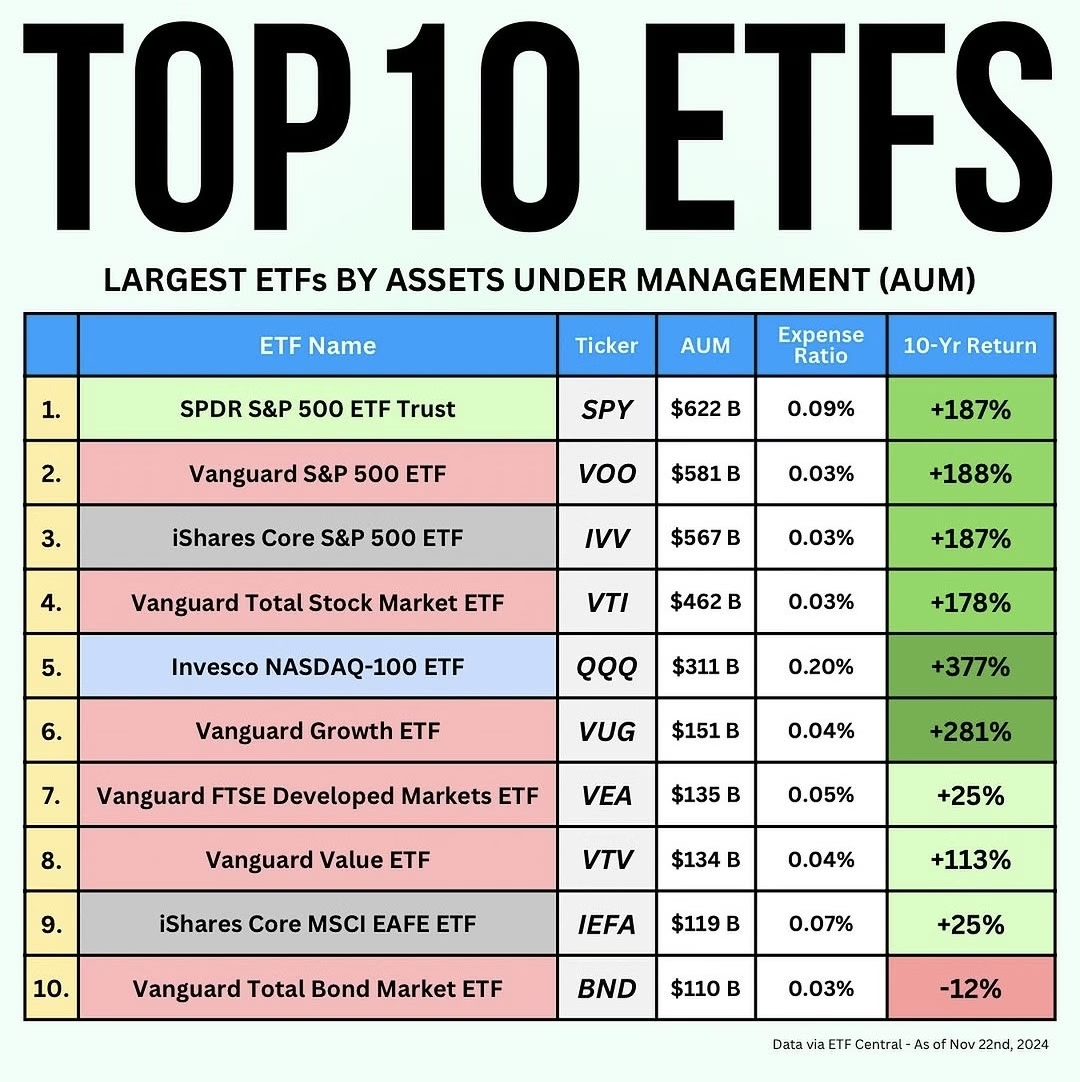

ETFs are renowned for offering low expense ratios, and that is a big savings for your earnings. Unlike in mutual funds, with high management fees, ETFs’ expenses can vary between 0.03%.

Over time, your savings compound, and your portfolio value appreciates immensely.

Flexibility and Accessibility make Ideal

Another great benefit of ETFs is liquidity—ETFs can be bought and traded during trading sessions, just like stocks. That makes them ideal for long-term and short-term investors alike.

With online brokerages, one can start investing in ETFs for at least $50. On top of that, with fractional shares, even lesser amounts can be invested, and ETFs have become more accessible than ever.

Debunking Myths: How ETFs Do Not Represent a Scam

Read more about managing emotions during market volatility to avoid common investment pitfalls.

Myth 1: Are Riskier Than Stocks

Reality: While all investments are risky, ETFs are diversified by design, which reduces volatility compared to individual stocks.

Myth 2: Require a significant investment

Reality: In most cases, there is no minimum investment required for ETFs. Moreover, with fractional shares, you can start investing with just a few dollars.

Myth 3: Only for Experts

Reality: ETFs are, in fact, one of the easiest investments for new investors to get started with. Furthermore, they make it simple to build a balanced portfolio. In addition, many brokers offer educational tools to help beginners understand and navigate the investment process.

How to Start Your Journey

Explore strategies for a balanced crypto portfolio to complement your investments.

Step 1: Set Your Goals

Are you preparing for your retirement, developing an emergency fund, or generating passive income? What your investment goals will inform your ETF selection

For example, a retiree may focus on income-generating, while a young executive may invest in growth-oriented funds.

Step 2: Choose the Right ETF

- Broad Market: Ideal for beginners (e.g., S&P 500 ETFs).

- Sector-Specific: Focus on industries like technology or healthcare.

- Thematic: Target trends like renewable energy or AI.

- Bond : Provide stable returns and lower volatility.

Step 3: Open a Brokerage Account

Platforms like Vanguard, Fidelity, and Robinhood make it easy to start. Look for one with low fees and user-friendly tools. Ensure the broker supports fractional share purchases if you’re starting with a small budget.

Step 4: Start Small and Stay Consistent

Begin with a modest investment to familiarize yourself with the process. Over time, increase your contributions as your confidence grows. Regular investments, even small ones, can lead to significant wealth accumulation through the power of compounding.

FAQs

Q: How much can I expect to earn with ETFs? A: Historically, broad-market ETFs like those tracking the S&P 500 have delivered annual returns of around 8-10% over the long term. However, returns can vary based on the type of ETF and market conditions.

Q: Are ETFs safe during a market downturn? A: While no investment is immune to losses, ETFs’ diversification helps cushion the blow compared to individual stocks. Bond ETFs or defensive sector ETFs may also provide stability during downturns.

Q: Can I lose money investing in ETFs? A: Yes, but diversifying your portfolio and holding investments long-term reduces the risk of significant losses. Staying invested during market fluctuations often leads to better outcomes.

Summary

Looking to deepen your investment knowledge? Discover the secrets of blockchain technology and how it’s shaping the future of finance.

ETFs Are Not a Scam: Here’s How They Can Make You Rich! By understanding how they work and debunking common myths, you can confidently take the first step in your investment journey. Remember, the key to financial success isn’t timing the market but time in the market. Consistency is crucial, so start small, stay disciplined, and let the power of compounding work for you.

Ready to take control of your financial future? Start exploring today and discover the opportunities waiting for you!

Subscribe to our newsletter to receive exclusive tips, updates, and investment strategies straight to your inbox. Stay ahead in your financial journey by signing up today!