Managing taxes can be a maze. Take one wrong turn, and you may end up paying more than you actually need to. Tax mistakes are costly, but don’t worry-you’re not alone. In this guide, we’ll dive into the most common tax mistakes people make and how you can avoid them like a pro! Ready to save some money and keep the tax authorities smiling? Let’s go!

The Top 3 Most Common Tax Mistakes and How to Avoid Them

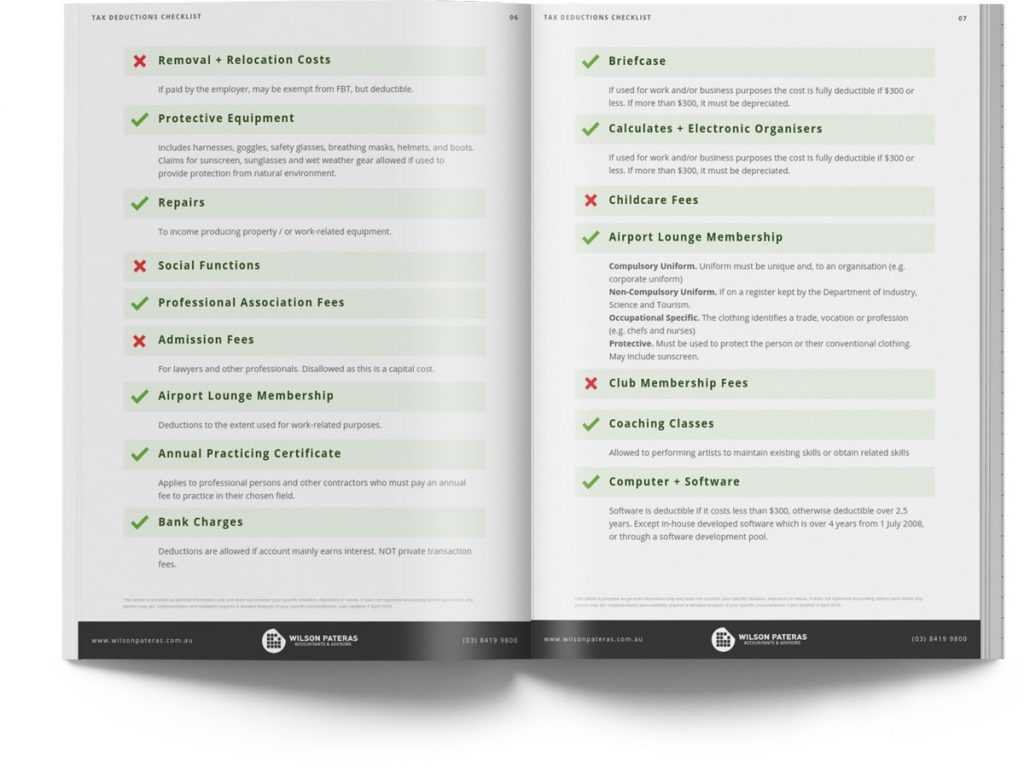

Some of the most common mistakes people make while filing taxes are not maintaining proper track of your deductible expenses. Typically, people miss out on a number of small, deductible expenses to which they’re entitled to bring their taxable income down. Second in line is not getting the difference between tax credits and tax deductions. Different and not knowing that is one sure way to miss some of the big savings. Lastly, failing to report all income, either from side gigs or investments, can create a real problem.

how will you avoid these tax mistakes? Easy: organize all your receipts and documents. Keep track of any potential deductions, and double-check your tax forms. If you want to dive deeper into the world of understanding tax credits versus tax deductions, check out this helpful resource by the IRS: Tax Credits vs. Tax Deductions: What’s the Difference?.

Paying attention to these little details will keep you from costly surprises at tax time.

Take Your Time: Why Rushing Through Your Tax Return Can Be Costly

We have all been there, wanting to hurry up and finish filing our taxes. After all, who does like staring at forms for hours? But, if you fly through your tax return, you can make some very expensive mistakes in taxes. Whether it be a miscalculation or an oversight, mistakes made in haste can delay your refund or result in penalties.

In short, the best way to be safe rather than sorry is to take your time and make sure everything gets reviewed upon submission. If you are not sure of anything, it is always good to consult a tax professional. It is always better to invest a little more time or money upfront than it is to try and fix a headache later on. Which, of course, means a few minutes now can save a lot of hassle later.

Hidden Tax Traps: How You Can Make These Sneaky Errors Without Even Trying

Let’s get real-some tax mistakes aren’t exactly a no-brainer. Did you know that failing to update your tax withholding when your life circumstances change can cost you money? It’s a common oversight but one that can equal a big tax bill at the end of the year, while lots of taxpayers neglect updating their address with the IRS, causing delays in receipt of key tax documents or refunds.

To avoid these sneaky tax mistakes, be proactive. Change your withholding every year so it’s set right, and make sure the IRS has a current address on file for you. Want more information on how to adjust your withholding and avoid any potential pitfalls? Check out this helpful guide from TurboTax: How to Adjust Your Tax Withholding.

These small steps may keep you away from larger headaches later!

Filing Status: The Most Common Mistake Persons Make

Filing taxes jointly with a spouse may sound like the easiest, but so many couples fall into a trap by always assuming this will be the best choice. Probably, there can be times when filing separately could serve a couple better. A leading mistake concerning couples is a failure to understand how different tax statuses can result in either cuts or credits.

You will not be able to take advantage of many of the tax benefits if you choose the wrong filing status. A wrong decision may highly affect your tax return. You must understand how all these tax policies impact your wealth because some great tax breaks might be dependent on your filing status. For example, filing jointly may provide you with more credits, but there could be situations where you get better benefits from filing separately.

Remember, you will need to consider all the pros and cons of filing jointly versus separately before making a decision. It is always advisable to consult a tax advisor for this one.

How to Fix Your Tax Mistakes (and Avoid Future Ones)

So you’ve made a tax mistake—well, join the crowd! The important thing is to fix it as fast as possible. If you catch an error, file an amended return right away. It will correct the mistake and probably save you from paying any penalties. Finally, take the time to learn from your mistakes. Organize your documents, track your deductions, and stay on top of tax laws so that next year you are prepared.

FAQs (Frequently Asked Questions)

1. How do I avoid the most common mistakes when filling out my return?

Track your expenses carefully, double-check those forms, and make sure you understand the difference between a credit and a deduction to avoid those tax mistakes. Take your time so that you can avoid costly errors.

2. What are the consequences if I make mistakes on my tax return?

Mistakes in your taxes could result in penalties, fines, or even a delay in getting back your refund. The quicker you correct them, the less an impact they will have on your wallet.

3.Are there any tax goof-ups that could possibly take away my getting a refund?

Yes, of course! The failure to claim all the available deductions or updates-not updating your address or withholding-keeps people from receiving the refund in full amount.

4. What do I do if I find out I made a tax mistake?

You can file an amended return to correct errors in taxes. This process helps adjust any errors and ensures you stay compliant with tax laws. Follow these tips and avoid some of the most common tax mistakes, and you will save money and be stress-free this tax season.